ROI (Return on Investment)

Contents

Definition

ROI stands for return on investment. This term is considered an essential concept in business and marketing. ROI is commonly used to calculate the profitability obtained from an investment, and as such, it is also considered a performance indicator. The figure is expressed in numbers, either as a ratio or as a percentage, and is usually a time-bound metric (i.e. it can be relative to a specific period of time). ROI can be applied to a variety of investments, from equipment to real estate and including investment in training programs, expanding into new markets, etc.

Formulas to calculate ROI

There are several formulas available to determine business ROI. Generally speaking, the calculation involves dividing the net profits obtained over a given period of time by the financial investment during that period.

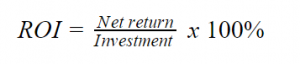

A basic ROI calculation would look like this:

For example, a business owner could be interested in purchasing a property in need of renovation to later resell it at higher market value. If the cost of acquiring and renovating the property is $500,000 and the selling price is $675,000, based on the formula above, their ROI calculation would be as follows:

Net return = $675,000 - $500,000 = $175,000

$175,000 ÷ $500,000 = 0.35

0.35 × 100 = 35

In this case, their ROI would be 35%. If the figure was negative, this would indicate losses.

What are the benefits of calculating the ROI?

Using this metric to calculate the ROI offers business owners several advantages. First of all, the formula is easy to apply and the results are easy to understand. Another benefit is that it can assist in decision making since it helps determine the viability of financial investment. Alternatively, it can support decision making by helping choose between different investment levels. By calculating the profitability of a new project, business owners can decide whether it makes financial sense to go ahead with it or not. Ultimately, a healthy ROI is linked to business survival, since good metrics indicate good revenue.

Moreover, this metric is a useful tool when it comes to monitoring expenses and budgets. As such, it can help business owners streamline their operations and minimize net losses. Lastly, return on investment calculations can be used in benchmarking. A business can research or estimate their competitor’s ROI and compare the performance of both companies.

Limitations

Ambiguity is one of the major limitations in the use of this metric. There is no universal number that determines what is a “good” ROI, since the concept is relative to predefined goals, the type of investment, and its ultimate purpose.

Return on investment figures are not a stand-alone number but are always relative to a limit value, a predefined figure that indicates the point at which an investment is worthwhile. For example, 8% could be deemed “good” ROI for a first-time investor in the stock market, but not when measuring the profitability of a global advertising campaign.

The time factor is another limitation. In multi-year investments, ROI needs to account for fluctuations in the value of money itself (e.g. inflation, exchange rates, etc.).

It’s also important to avoid seeing ROI metrics as a prediction. This calculation is used to gauge the financial benefits of a business decision, but it does not account for the likelihood of profits and costs matching the initial calculations.

ROI in marketing: ROMI and ROAS

Within the field of marketing, ROI is expressed as either ROMI or ROAS. ROMI is a sub-metric used to define the return on a marketing investment, whereas ROAS stands for return on advertising spend. These two concepts can help plan a results-driven marketing strategy.

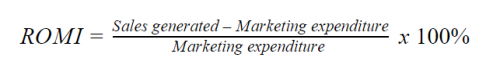

The following formula can be used to calculate ROMI:

For example, a company may want to determine the effectiveness of a marketing campaign that involved working with an influencer. The campaign generated $7,500 while the influencer’s fee was $1,500. To find out their ROMI, the calculation would be as follows:

($7,500 - $1,500) ÷ $1,500 = 4 × 100 = 400%

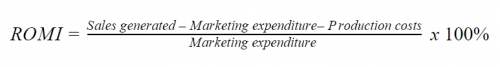

Business who sell physical products may need to use ROMI formulas that take into account the cost of goods, in which case the calculation would be as follows:

Using the example above, but assuming the campaign was to sell physical products whose cost was $750, ROMI would be calculated as follows:

($7,500 - $750 - $1,500) ÷ $1,500 = 3.5 × 100 = 350%

As for ROAS, the standard formula is:

![]()

For example, a company that ran a Google Ads campaign that cost them $3,500 and generated $7,500 would find the return generated by those ads through this calculation:

ROAS = $7,500 ÷ $3,500 = 2.1 × 100 = 210%

The resulting figure means that for each $1 invested in advertising, the company earned $2.1.

As it happens with ROI, defining what is a good ROMI or ROAS metric is relative to the goals defined prior to the campaign or investment.

Related links

- https://blog.hootsuite.com/measure-social-media-roi-business/

- https://support.google.com/google-ads/answer/14090?hl=en

Similar articles

| About the author |

|